What Is Asset Allocation And Why It Matters

The way your investment portfolio is allocated between stocks and bonds is the single most important determiner of the investment risk and returns you are likely to experience. How sure are you that you made the right choices?

A Story

A Story

Remember when you started your job and were given the paperwork to sign up for the company’s retirement plan? It was probably given to you during a long day of signing other forms for insurance coverages, tax withholdings, and direct deposit. Like most people, you probably felt a little bit overwhelmed and set it aside promising to get back to it later. Later came when your employer followed up with you to ask how much you wanted to begin contributing to your retirement account. That is when you remembered the investment paperwork you never reviewed, so you asked a coworker and selected the same things they had selected for themselves.

This is a common story and it’s understandable. Reading through prospectuses and making investment selections is not how most people want to spend their time. It’s also not something most people feel confident doing themselves, which is the same way I feel about replacing the brake pads on my car. But what you invest in, and more specifically, how you distribute your money across different asset classes can have a tremendous impact on how much your money grows and whether the risk you take is something you’ll be comfortable with the next time there is a financial crisis.

According to a study completed by Vanguard titled The Global Case for Strategic Asset Allocation, 88% of the volatility and returns experienced in a diversified portfolio can be traced back to how the money was allocated. What this study suggests is that how your money is invested in stocks and bonds is far more important than any other factor you might use to select securities in your portfolio.

An Example

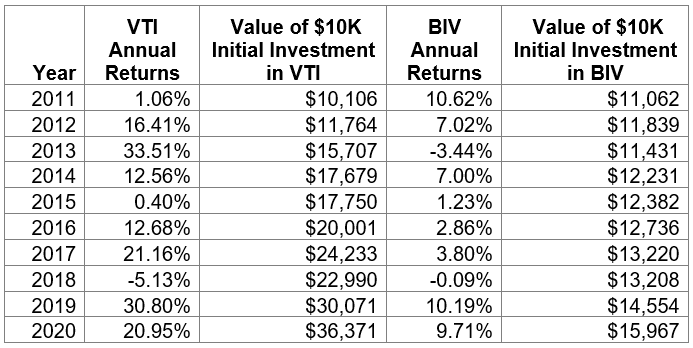

Consider the annual returns of two Vanguard funds over the last ten years, one of which is invested entirely in stocks and the other in only bonds. Note: I’m choosing to use funds from Vanguard to illustrate my point because the information is publicly accessible and Vanguard has a good reputation for providing reliable data. The figures shown are the annual total returns by NAV after the expense ratio charged by Vanguard has been assessed.

The first fund is the Vanguard Total Stock Market Index (Ticker: VTI). This fund is composed entirely of U.S.-based stocks of publicly traded companies ranging from small to large. The cost of investing in this fund is 0.03% per year ($3.00 for every $10,000 invested). The second is the Vanguard Intermediate-Term Bond Index (Ticker: BIV). This fund is composed entirely of U.S.-based bonds that have high credit quality. The bonds held in the fund were issued by the U.S. government as well as corporations. The cost of investing in this fund is 0.05% per year ($5.00 for every $10,000 invested).

A single investment of $10,000 in VTI at the start of 2011 would have been worth $36,371 at the end of 2020. This assumes that all dividends were reinvested and no additional contributions were made. That’s an average return of 14.44% annually and there was only one instance over the past decade where the annual return was negative for the calendar year! Even so, you would have still experienced a bumpy ride in an all-stock portfolio and you don’t have to look very far back to find evidence of this.

The first quarter of 2020 was the worst three-month period to be invested in VTI over the past ten years. During this period, the fund declined by 20.85%. In fact, the fund experienced eight quarterly declines over the last decade and three of those declines exceeded 10.00%. These swings in value are what is known as volatility, which is a way of measuring the risk of a security.

Now compare this to a single investment of $10,000 in BIV over the same time period. As outlined above, an investment would have been worth $15,967 at the end of 2020. This assumes that interest payments from the bonds were reinvested and that no further contributions were made. That’s an average annual return of 4.89%, which is not so impressive given the performance of the all-stock portfolio.

However, what is less apparent is that the all-bond portfolio had significantly less volatility. Over the ten-year period, the worst quarterly result the fund experienced occurred in 2016 when it declined by 4.15% between October and December. Moreover, when VTI lost more than twenty percent of its value during the first quarter of 2020, BIV posted a 3.07% gain. This illustrates two main benefits of bonds: they stabilize portfolios because they are generally less volatile and they tend to perform better when stocks do poorly.

Back to the Story

Investing entirely in one option over the other would have led to very different outcomes in your account a decade later. The fluctuations in value you would have experienced along the way would also have been very different. This is why asset allocation is so important. Too little risk and you miss opportunities that may be necessary to grow your money. Too much risk and you may find yourself suffering through wild swings that test your resolve to remain invested. Getting your asset allocation right is all the more important when you consider the effects of compounding during your working years and then your need for a steady income in retirement. This is not something you want to let your coworker decide for you.

For most investors, allocating money in some measure between these two choices is best but it depends greatly on your individual circumstances. It’s a decision that should be made after considering a number of different factors, including but not limited to your: age, employment stability, amount of cash you keep on-hand, current and future income, comfort with risk, and your financial goals. As these factors change, so will the way you allocate your investments. Determining a proper asset allocation, along with developing a retirement plan, is helpful in answering the question: How much money should I be saving for retirement?

Conclusion

Asset allocation is the single most important determiner of the investment risk and returns you’re likely to experience in your portfolio. It is best chosen after considering a number of factors specific to your unique situation.

If you need help determining an appropriate asset allocation for your investment accounts, a comprehensive review of your financial situation will help you to make an informed decision that balances risk and the potential for returns. If you are interested in learning more about how a financial plan can benefit you, please contact us today.